More recently, it has moved into the mobile computing market, where it produces Tegra mobile processors for smartphones and tablets as well as vehicle navigation and entertainment systems. They are deployed in supercomputing sites around the world. Several equities research analysts have commented on NVDA shares.

Nvda price to revenue update#

The company also provided an update on the Arm Holdings acquisition that it had announced last year. The firm had revenue of 6.70 billion during. Operating Margin > NVDA Operating Margin has increased from 33.7 to 37. However, if we break the over head resistance we head higher. Were currently rejecting off the top trend line and should reach 115-120. NVDA has formed a descending channel that can be spotted on the 1hr, 2hr, 4hr and Daily time frames. It expects an adjusted gross margin between 66.5-67.5 in the quarter. NVDA is rejecting near the 134-135 region which is acting as the current resistance. In addition to GPU manufacturing, Nvidia provides an API called CUDA that allows the creation of massively parallel programs which utilize GPUs. NVDA provides guidance NVDA said that it expects to post revenues of 6.80 billion in the current quarter with a variance of 2 on both sides.

Nvda price to revenue professional#

Its professional line of GPUs are used in workstations for applications in such fields as architecture, engineering and construction, media and entertainment, automotive, scientific research, and manufacturing design. Nvidia is a global leader in artificial intelligence hardware and software.

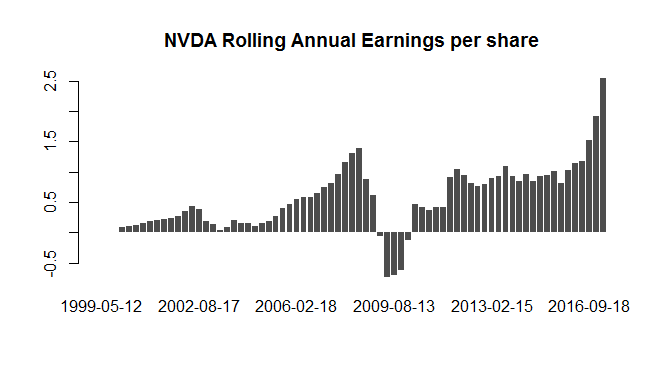

NVDA closed out its 2022 fiscal year with strong 53 revenue growth and 103 EPS growth. (BTW, if you’re a believer in genomics and you don’t own Illumina shares. NVDA started 2020 trading at around 59 per share. They’re a company that is powering some of the most exciting emerging technologies we see outside of genomics.

Nvda price to revenue software#

It is a software and fabless company which designs graphics processing units, application programming interface for data science and high-performance computing as well as system on a chip units for the mobile computing and automotive market. According to Wall Street analysts, the average 1-year price target for NVDA is 205.63 USD with a low forecast of 111.1 USD and a high forecast of 336 USD. NVDA stock price skyrocketed in 2016 because all the institutional investors realized throughout the year that Nvidia isn’t just a graphics chip company. NVIDIA Corporation is an American multinational technology company incorporated in Delaware and based in Santa Clara, California.

0 kommentar(er)

0 kommentar(er)